Development of international Aluminium market – Why your eyes should be on China

China, the world’s largest Aluminum producer is also the world’s largest metal consumer. Responsible for more than 40 per cent of consumption, up from 4 per cent in 1980. Many traders believe the SME (Shanghai Metal Exchange) has taken the place of the LME (London Metal Exchange), in the short term, as a key price centre for the world’s Aluminium trade. This was brought on in 2012 when the LME was bought by the Hong Kong Stock Exchange. Since the acquisition the LME has made it a strategic priority to seek out more trading volumes from China.

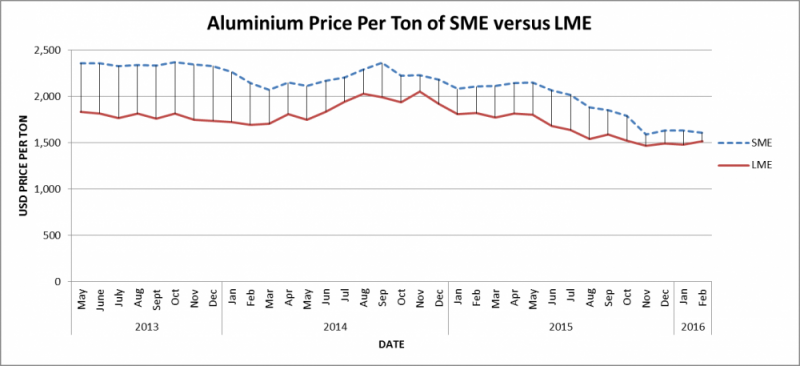

Over the last 5 years the SME has been quoting prices well above the LME. In 2013 the difference was more than $500 US. In 2015 the LME Aluminium price fell below $1,500/MT for the first time in more than 6 years. It is clear from the graph above that over the last months this gap has narrowed to less than $100 US. Some traders think this gap will continue to decrease and that the SME will fall below the LME like in 2008.

Chinese semi-finished Aluminium products are becoming even more competitive against western producers because of:

- Reduction of high premiums charged on top LME prices in Asia, Europe and USA

- The slowdown in local demand for Aluminium products pressures Chinese extruders to focus on exporting to keep production volumes high

- The weaker Yuan/USD exchange rate makes Aluminum products from China more attractive for customers of Chinese suppliers

For the moment the price of LME has stabilized around $1500 US. No one can predict the future but your business can depend on Lodec Jinshu to keep you informed. Focus on your business and let us take care of supplying you with semi-finished Aluminium products from China.

If you have any questions please don’t hesitate to contact us.